Bienvenue chez Inter-Choix

La vente ou l’achat de votre propriété reste l’évènement économique le plus important de votre vie, alors il est important de faire les bons choix.

Inter-Choix courtier immobilier agréé enr. est une autre façon de vendre ou d’acheter dans la région du grand Montréal (au Canada). C’est un système où l’on ouvre toutes les portes aux acheteurs comme aux vendeurs et ce, sans payer de commission exagérée.

Faciliter les transactions immobilières entre deux particuliers ou avec intermédiaires, le résultat sera toujours le même:

LA SATISFACTION DE NOS CLIENTS.

Notre but est de rapprocher les acheteurs immobiliers grâce à des services exemplaires, une équipe efficace, et ce, avec des frais raisonnables.

Bienvenue chez vous

Nous offrons une multitude de services pour l’achat de votre prochaine propriété. Voici un apperçu des services offerts chez Inter-Choix

- Service personnalisé

- Accès aux propriétés de la compagnie Inter-Choix

- Accès aux reprises de finance

- Accès au réseau M.L.S (S.I.A)

- Accès à une multitude de professionnels pour vos besoins de rénovation, décoration, déménagement, notaire, inspecteur en bâtiment, arpeuteur géomètre, etc..

- Accès à un professionnel sur place pour la rédaction des offres d’achats

- Conseils pour tout achat, que ce soit avec ou sans intermédiaire

- Achat selon votre rythme, goût, budget et disponibilité

- Vérification de votre crédit sans engagement de votre part

- Et bien plus encore…

Nous offrons une multitude de services pour la vente de votre propriété. Voici un apperçu des services offerts chez Inter-Choix

- Installation d’une enseigne “À VENDRE”

- Conseils pratiques pour la vente entre particulier (sans intermédiaire)

- Références de professionnels: arpenteur, notaire, inspecteur en bâtiment, etc…

- Filtration des appels téléphoniques par un agent immobilier

- Inscription de la propriété dans le livre M.L.S.

- Inscription de la propriété dans les sites internet : M.L.S/S.I.A, Inter-Choix.com et Micasa.com

- Inscription de la propriété dans le système “Edgard”

- Photo et description de la propriété remises au propriétaire-vendeur

- Envoie de la fiche technique aux acheteurs intéressés

- Conseils et rédaction des offres d’achat par un agent immobilier

- Estimation de la valeur marchande de votre propriété

- Et bien plus encore…

Pour un service de qualité, voici des partenaires sur lesquels vous pouvez compter en tout temps.

Chez Stéphan Roy et ass., nous sommes arpenteurs-géomètres depuis plus de 20 ans. Nous saurons vous fournir les documents officiels dont vous avez besoin pour concrétiser votre projet ou pour établir vos limites de propriété.

En ce qui concerne votre hypothèque, il est important de vous assurer d’acheter la maison que vous voulez vraiment en optant pour des solutions de financement souples qui vous conviennent. Je peux vous aider à obtenir l’hypothèque dont vous avez besoin en fonction de votre style de vie pour que vous puissiez atteindre votre objectif d’accession à la propriété.

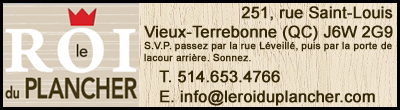

Nous offrons une vaste gamme de planchers de bois franc de qualité supérieure à des prix imbattables. Spécialisé dans la recherche et la vente de plancher de bois franc, Le Roi du plancher saura certainement desservir tous vos goûts et budgets.

Que ce soit dans la conception, la réalisation de vos besoins ou encore notre capacité à vous offrir un service hors du commun, nous vous garantirons chez Webfacile la meilleure expérience web possible!

INTER-CHOIX ENR.

Courtier Immobilier Agrée

- 3095 Autoroute Jean-Noël-Lavoie, Laval, QC H7P 4W5

- (514) 570-3325

- info@inter-choix.com